Managing our finances can be tricky. We often hear about frugal living and cheap living. But what do these terms really mean? Knowing the difference is key to smart money habits.

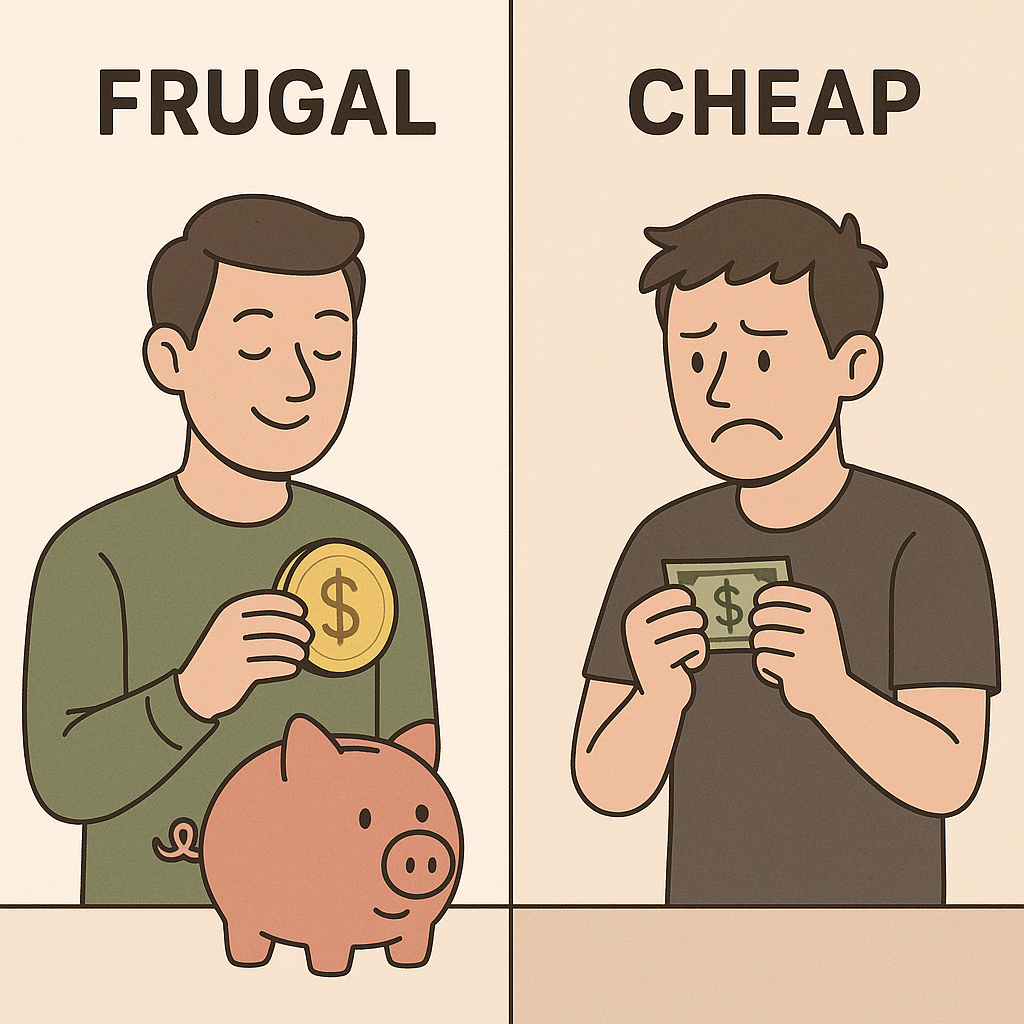

Frugal living means being careful with your money. It’s about making smart choices, not just saving money. Cheap living, on the other hand, focuses on low costs. But it might mean sacrificing quality.

Smart spending habits can really help your finances. By understanding frugal and cheap living, you can make better choices. This way, you can reach your financial goals more easily.

Understanding Frugality and Cheapness

In personal finance, frugality and cheapness are often mixed up. But they mean different things. Knowing the difference helps you live within your means.

Let’s explore what frugality and cheapness really mean. We’ll look at their definitions and the beliefs behind them.

Defining Frugality: Value-Based Mindset

Frugality is about spending wisely, focusing on quality and value. It’s about getting the most out of what you buy. This doesn’t mean giving up comforts or needs. It’s about making smart choices that fit your budget and values.

For example, buying a durable, energy-saving appliance is frugal. It saves money on energy and reduces the need for frequent replacements.

Defining Cheapness: Price-Based Mindset

Cheapness, on the other hand, is all about the lowest price. It might mean sacrificing quality. This can lead to spending more in the long run.

Choosing the cheapest light bulbs might save money at first. But if they burn out quickly and use more energy, it’s not a smart choice.

Knowing the difference between frugality and cheapness helps you make better financial choices. It ensures your spending matches your values and goals.

Frugal vs. Cheap: What’s the Difference?

Being frugal and being cheap are two different ways to save money. They have different philosophies and outcomes. Frugality focuses on getting the most value without sacrificing quality. Cheapness, on the other hand, is all about saving money, even if it means lower quality.

Core Philosophical Differences

Frugality is about making smart choices based on what you value. It means spending wisely and choosing things that last. Cheapness, on the other hand, is about finding the lowest prices, even if it means lower quality.

This difference in thinking shapes how people make financial decisions. Frugality leads to more sustainable and thoughtful choices.

Long-Term vs. Short-Term Thinking

Frugality looks at the big picture, considering long-term benefits. Cheapness, by contrast, focuses on quick savings, without thinking about the long-term costs.

- Frugality: Investing in quality products that last longer.

- Cheapness: Opting for the cheapest alternatives, potentially leading to more frequent replacements.

Quality Considerations and Value Assessment

Frugality values quality over price, seeing long-term savings and satisfaction. Cheapness, on the other hand, might sacrifice quality for immediate savings, leading to less value overall.

Knowing these differences helps people make better choices that fit their financial goals and values.

Psychological Aspects Behind Both Behaviors

Why do people choose to be frugal or cheap? It’s all about their psychology. Financial choices are shaped by deep-seated psychological factors. These factors greatly affect how we spend and manage money.

Motivations for Frugality

Frugality comes from a desire to be sustainable and value-focused. People who are frugal aim for long-term financial security. They’re ready to make sacrifices now to reach their financial goals.

This mindset values getting the most out of what they have. It’s not just about saving money, but about making every dollar count.

Motivations for Cheapness

On the other hand, cheapness is about saving money now and avoiding spending. Those who are cheap focus on quick financial wins. They might choose cheaper options, even if they’re not the best value in the long run.

This approach can lead to decisions that might not be the best for the future. It’s all about saving money right away, without thinking about the long-term effects.

How Upbringing Shapes Financial Habits

Our upbringing greatly influences our financial habits. It can make us more frugal or cheap. Growing up in a financially responsible household tends to make someone more frugal. They focus on getting the most value for their money.

On the other hand, those who grew up with financial stress might become cheap. They focus on saving money now, even if it means sacrificing quality or value later.

Understanding the psychology behind frugality and cheapness helps us make better financial choices. It leads to healthier money habits.

Real-Life Examples in Everyday Situations

The difference between being frugal and cheap is real. It shows up in many parts of our lives. Knowing how these mindsets play out can help us make better choices and build stronger relationships.

1. Shopping and Purchasing Decisions

A frugal person might choose quality over price. They might buy something more expensive but it lasts longer. On the other hand, someone who is cheap might go for the cheapest option, even if it’s not as good.

For example, a frugal person might pick a durable, but pricier, brand of clothes. A cheap person might choose fast fashion, ignoring the environmental and social effects.

2. Social Situations and Relationships

In social settings, being frugal means making thoughtful choices. Like suggesting a potluck instead of a pricey restaurant. Cheapness, on the other hand, might lead someone to skip social events to save money, hurting relationships.

A frugal person might find free or low-cost activities for everyone. This way, they keep social bonds strong without spending too much.

3. Home and Personal Maintenance

At home, being frugal means regular upkeep and repairs. This way, things last longer. A cheap approach might ignore repairs until they’re big problems, costing more later.

For instance, a frugal homeowner might keep their HVAC system in good shape. A cheap person might delay maintenance, risking a big repair bill.

Looking at these examples, we see frugality is about making smart, value-based choices. Cheapness is about saving money, no matter the cost later.

How to Practice Healthy Frugality

Healthy frugality is not about cutting back too much. It’s about making smart choices that fit your financial goals. It’s a way of living that values being smart with money and taking care of the planet.

To start practicing healthy frugality, first, you need to watch how you spend money. This means knowing where your money goes and deciding how to use it wisely.

1. Mindful Spending Strategies

Mindful spending is more than just saving money. It’s about buying things that really matter to you and fit your values.

- Track your expenses to understand your spending patterns.

- Avoid impulse buys by implementing a waiting period before purchasing non-essential items.

- Consider the long-term value of your purchases.

2. Balancing Quality and Cost

Finding the right balance between quality and cost is key to healthy frugality. It’s not just about picking the cheapest thing. It’s about finding the best value for your money.

- Invest in quality products that are durable and long-lasting.

- Compare prices and look for deals or discounts.

- Consider the total cost of ownership, including maintenance and repair costs.

3. Setting Financial Priorities

Knowing what’s important to you financially is crucial for healthy frugality. This means setting clear goals and using your money to reach them.

- Identify your short-term and long-term financial goals.

- Allocate your income into categories based on priority.

- Review and adjust your budget regularly to ensure you’re on track with your goals.

By using these strategies, you can live a frugal life that’s good for your wallet and your happiness. You don’t have to give up quality or joy.

Embracing Frugal Living for a More Fulfilling Life

Understanding the difference between frugality and cheapness is key. A frugal lifestyle can greatly improve your financial health and happiness. By knowing the difference, you can make choices that match your values and goals.

Healthy frugality means spending wisely, focusing on what’s important, and valuing quality. This way of living is not just good for your wallet. It also makes you happier and more secure in the long run.

Living frugally can make your life more meaningful and intentional. Think about how frugal living can make your life better. It can lead to a more balanced and prosperous life.